Forex trading signals are invaluable tools that can enhance your trading strategy and improve your chances of success. By understanding how to effectively utilize these signals, traders can navigate the complexities of the forex market more efficiently. For comprehensive resources on forex trading, you can visit forex trading signal Forex Vietnam.

What Are Forex Trading Signals?

Forex trading signals are suggestions or recommendations to buy or sell a currency pair. These signals can be generated by human analysts or automated trading systems. They are typically based on a combination of technical analysis, market trends, and other economic factors.

Types of Forex Trading Signals

There are two primary types of forex trading signals:

1. Manual Signals

Manual trading signals are created by experienced traders or analysts who analyze market conditions and provide their insights to others. This form of signal generation can be subjective, as it often depends on the trader’s experience and intuition.

2. Automated Signals

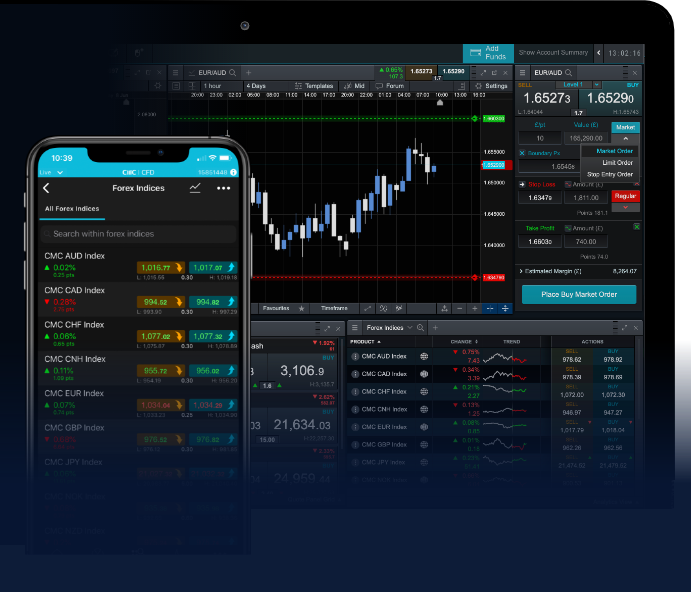

Automated trading signals are generated by algorithms and trading bots that analyze vast amounts of market data and execute trades based on predetermined criteria. These signals can be beneficial for traders who might not have the time or expertise to analyze the market themselves.

How to Use Forex Trading Signals Effectively

To make the most out of forex trading signals, traders should follow these guidelines:

1. Choose a Reliable Source

Finding a reputable source for forex signals is crucial. Look for providers with a proven track record and positive reviews. Many traders rely on well-established platforms and tools that provide reliable signals.

2. Understand the Signals

It’s essential to understand what the signals mean. Most signals will indicate the currency pair, the action to take (buy/sell), entry and exit points, as well as stop-loss and take-profit levels.

3. Risk Management

Proper risk management is vital when trading forex. Always set stop-loss orders to minimize potential losses. It’s also wise to only risk a small percentage of your trading capital on any single trade.

4. Combine Signals with Your Analysis

While forex signals can provide valuable insights, combining them with your market analysis can increase your odds of success. Use signals as a supplementary tool rather than the sole basis for your trading decisions.

The Benefits of Using Forex Trading Signals

Forex trading signals can offer several advantages:

1. Time-Saving

Trading signals can save traders considerable time by providing timely suggestions for trades. Instead of spending hours analyzing charts and data, traders can receive direct recommendations for action.

2. Improved Accuracy

Many traders find that using forex signals improves their trading accuracy. By relying on expert analyses or automated systems, traders can benefit from insights they might not have considered on their own.

3. Accessibility for Beginners

Forex signals can be particularly beneficial for novice traders who may not yet have a deep understanding of market analysis. Signals can help them make informed decisions without needing extensive experience.

Challenges of Using Forex Trading Signals

While there are many benefits, there are also challenges:

1. Dependency on Signal Providers

Relying solely on trading signals may lead to a lack of independent analysis and critical thinking. Traders must strike a balance between utilizing signals and developing their trading skills.

2. Market Volatility

The forex market can be highly unpredictable. Signals that may have worked in the past might not necessarily be effective in the future. Traders must remain vigilant and adaptable to changing market conditions.

3. Potential for False Signals

Not all signals are created equal; some may result in losses if the trader does not assess the market post-signal. Therefore, it is essential to do due diligence and carefully evaluate the quality of the signals received.

Conclusion

Forex trading signals can significantly enhance your trading strategy when used correctly. By choosing reliable signal sources, understanding the signals, and incorporating risk management practices, traders can maximize their chances of success. Though there are risks involved, the potential for improved trading performance makes forex signals a valuable resource for both novice and seasoned traders alike.

Your Next Steps

If you’re serious about trading forex and want to improve your strategy, consider exploring various signal providers, backtesting their signals, and integrating them into your trading plan. With the right approach, forex trading signals can become an indispensable part of your trading toolkit.